News & Bulletins

Huaxin Viewpoint: Review of Hang Seng Technology Index

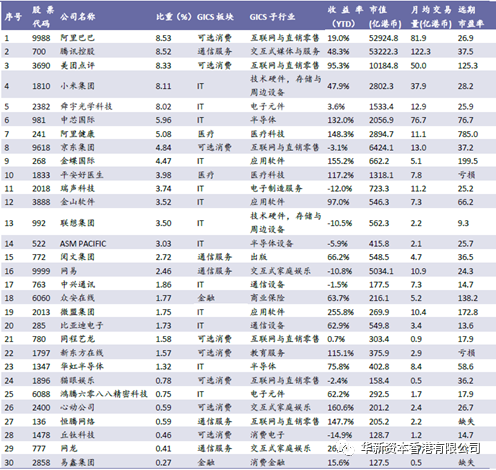

2020-09-25Launched on July 27, 2020, Hang Seng Technology Index is a technology stock index listed in Hong Kong, reflecting the overall performance of technology companies listed in Hong Kong. The index is calculated by Hang Seng Index Co., Ltd. and calculated by the market value of 30 Hong Kong listed technology companies, and reviewed quarterly. At present, most of the 30 companies are from mainland China, accounting for 99.25%. Hang Seng Technology Index is regarded as the Hong Kong version of NASDAQ.

In the Hang Seng Technology Index, Alibaba, Tencent, Meituan and Xiaomi accounted for more than 30% of the total. According to the industry, there are 18 IT (60%), 3 non essential consumption (10%), 3 industrial (10%), 2 financial (6.7%) and 2 medical care (6.7%) stocks in the science and technology index.

According to the retrospective calculation data of Hang Seng Index Co., Ltd., the Hang Seng Science and Technology Index recorded a return of 36.2% in 2019, and has risen 52.25% since 2020, significantly outperforming the Hang Seng Index (down 13.08%) and the Hang Seng SOE Index (down 12.68%). As more and more new economy stocks listed in the United States are listed in Hong Kong for the second time, the Hang Seng Technology Index may promote the fund's pursuit of technology stocks and generate positive feedback.

The Hang Seng Science and Technology Index has outperformed the market since it was launched more than a month ago. From July 27 to September 18, the Hang Seng Technology Index rose 7.42%, the Hang Seng Index fell 1.01%, and the Hang Seng SOE Index fell 2.76%. Among them, component stocks showed different performances, with 14 stocks rising and 15 stocks falling. The biggest gainer was BYD Electronics, up 79.96%; The biggest drop was Raytheon Technology, down 21.24%. Alibaba, Tencent, Meituan, Xiaomi and Sunny Optics, which account for the largest proportion of the index, rose 12.80%, fell 0.57%, rose 26.69%, rose 46.03% and fell 11.01% respectively. Companies in the middle of the index showed weak performance, with Alibaba Health, JD, Kingdee, Ping An Gooddoctor and Raytheon Technology falling 8.01%, up 24.28%, 6.54%, down 2.13% and down 21.24% respectively. Among the small market value companies, except for BYD Electronics, which recently obtained the contract manufacturing from Apple, the performance of most other companies is not ideal. Therefore, on the whole, the reason why Hang Seng Science and Technology Index can outperform the market is mainly driven by several powerful leading stocks.

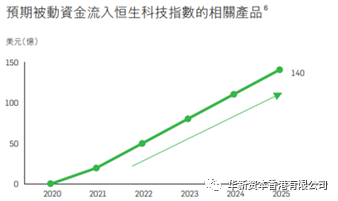

Although the Hang Seng Technology Index was launched less than two months ago, related ETFs and other fund products have emerged in the market, including Hang Seng Technology ETF (03032. HK), Southern Hang Seng Technology (03033. HK), Huaxia Hang Seng Technology (03088. HK) and Asus Hang Seng Technology (03067. HK) tracking the index. In addition, a number of fund companies, including Harvest Fund, Bosch Fund and Huaxia Fund, have officially reported Hang Seng Technology ETF (QDII) related products. According to the calculation of Hang Seng Index Co., Ltd., the fund for tracking ETF as a whole in the future will increase to 14 billion yuan in 2025, thus driving more funds to flow into the constituent stocks of the index.

In addition, Hang Seng Technology Index has a rule for quick inclusion of new shares. Assuming that the closing market value of the new shares on the day of listing ranks among the top 10 constituent stocks of the existing index, the new shares will be included in the index. The participation of constituent shares is generally implemented after the closing of the 10th trading day after the listing of the new shares. This mechanism makes it easier and faster for the newly listed technology giants in Hong Kong and the leading companies of China General Shares returning to the Hong Kong stock market to be included. Therefore, Ant Financial may be included in the index in the second half of the year.

As more and more scientific and technological unicorns and leading Chinese companies have successively landed in the Hong Kong stock market, more and more passive funds will pay attention to the Hang Seng Science and Technology Index in the future. At present, Alibaba, Tencent and Meituan, which account for a relatively high proportion, will continue to benefit, but their impact is very limited compared with the company's current market value, especially the short-term impact can be almost ignored. In the long run, investment in technology stocks will return to the fundamentals of the company. In the general environment of low interest rates, there will be more funds chasing growth stocks. Science and technology are the primary productive forces, and excellent high-tech companies are bound to continue to outperform traditional industries for a long time. Technology companies that can achieve long-term profitable growth will become stronger and stronger. It is worth our patience to make long-term investments.