News & Bulletins

Huaxin Capital's Viewpoint: Analysis of Medical and Aesthetic Industry and Investment Target (1)

2021-06-251、 Flourishing sunrise industry

Medical cosmetology is a kind of cosmetology that uses drugs, surgery, medical devices and other methods to repair and reshape the appearance and the shape of various parts. Medical beauty is an extension of beauty consumption demand, which integrates medical and consumption attributes. It is a high-quality track with high medical threshold and high consumption ceiling. According to the operation mode, it can be divided into surgery and non surgery. Among them, surgery also refers to weighing plastic surgery, which refers to traditional medical and aesthetic plastic surgery projects, mainly including facial plastic surgery, maxillofacial plastic surgery, chest plastic surgery, etc; Non surgery, also known as micro plastic surgery or light medical beauty, refers to the use of non-invasive or minimally invasive therapy to meet the needs of consumers, mainly including injection filling, photoelectric projects, skin management, etc. The light medical beauty project has higher market acceptance and repurchase rate, and the market scale is growing faster.

The scale of the global medical beauty market grew steadily. In 2019, the global medical beauty market reached 145.9 billion US dollars, with a five-year compound growth rate of about 8.9%. The market size of China's medical beauty industry reached 176.9 billion yuan, accounting for about 18.6% of the global medical beauty market. From 2009 to 2019, China's medical and aesthetic penetration rate continued to increase, from 0.1% to 3.6%, but it still lags behind major countries in the world, about 1/3 of Japan, 1/5 of the United States, and 1/6 of South Korea. Over the past five years, China's market size has maintained a growth rate of more than 20%, far higher than the world average. According to ISAPS prediction, China's scale is expected to exceed 300 billion yuan in 2023, and the industry will maintain a high boom in the next five to 10 years.

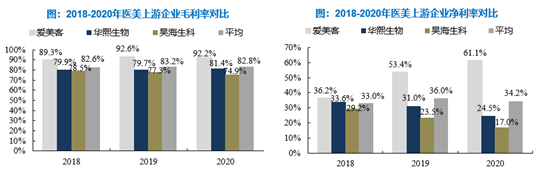

It is split from top to bottom along the industrial chain, and the main links include upstream raw material suppliers, midstream pharmaceutical manufacturers and equipment suppliers, downstream medical beauty service institutions, and customer acquisition channels. From the gross profit and net profit of the industrial chain, the gross profit margin of upstream medical beauty drugs, consumables, medical beauty devices, etc. is usually 75% - 95% because of the long period of product development, registration and approval, and the high technical barriers to production. Because of different business models, the enterprise's period expense rate varies greatly, so the net profit rate has a significant difference. The industry average is about 35%, while the net profit rate of leading companies, such as Aimeike, is as high as 61%.

From the gross profit and net profit of the industrial chain, the gross profit margin of upstream medical beauty drugs, consumables, medical beauty devices, etc. is usually 75% - 95% because of the long period of product development, registration and approval, and the high technical barriers to production. Because of different business models, the enterprise's period expense rate varies greatly, so the net profit rate has a significant difference. The industry average is about 35%, while the net profit rate of leading companies, such as Aimeike, is as high as 61%.

Compared with the high barriers and high gross profits in the upstream, the medical beauty drug and instrument dealers in the midstream have weak bargaining power in the upstream and downstream due to their decentralized pattern, and their gross profit and net profit levels are low. The gross profit margin is usually 50% - 70%, the period expense rate is generally 40% - 60%, and the net profit margin of regional medical beauty institutions can reach 15% - 20%. Benefiting from the high profile of the industry, the whole industry is now able to achieve profitability.

The gross profit rate of the downstream medical beauty service institutions is between 40% - 70%. However, due to the low concentration of the downstream market and fierce competition, a large number of rebates and fees need to be given to the channel, resulting in a very high customer acquisition cost. The net profit rate of the institutions is only about 10%. Therefore, the upstream is the core of the profit of the medical beauty industry chain and the best subdivision track of medical beauty.

From the perspective of medical beauty products, the domestic injection medical beauty products are mainly hyaluronic acid and botulinum toxin. The market share of hyaluronic acid/botulinum toxin in injectable Yimei reached 66.6%/32.7% respectively. However, by 2019, the market share of regular botulinum toxin and hyaluronic acid was only 30%, and the market share of smuggled goods was relatively high. As the supervision of medical and aesthetic industry becomes stricter, it will be beneficial for formal medical and aesthetic institutions and manufacturers to obtain stock market shares.

China has approved 49 kinds of hyaluronic acid products (overseas brands account for 70% of the market). In 2019, the market scale of hyaluronic acid filler in China was about 4.76 billion yuan, with a CAGR growth rate of 31.5% from 2014 to 2019. Under the fierce market competition, domestic brands seize the market through product iteration, product innovation and differentiation positioning.

Prior to 2020, the only botulinum toxin products approved in China were Erjianbaotuoshi from the United States and Hengli from Lanzhou Biology, China. In 2020, with the approval of Geshi and Lettibo, the competition pattern of the industry will shift from two leading enterprises to four leading enterprises. In 2019, the scale of China's formal botulinum toxin market reached 3.6 billion yuan, and the CAGR growth rate from 2015 to 2019 was 31.6%. Although all companies actively carry out the layout, due to the high technical threshold of botulinum toxin and the long approval process, it is expected that the industry will have a "blank window period" of 2-3 years.